TOP-Stax.ai $7M

Raises

| Domain | Amount |

|---|---|

| Stax.ai | $7M |

| TrueMarkets.org | $4M |

| CredFlow.in | $3.7M |

| Exponent.finance | $2.1M |

| AtMoves.nl | $1.56M |

| FlightClaimEU.com | $1.35M |

| Geheco.com | $520K |

| SilFabSolar.com | $100M |

| TailorMed.co | $40M |

| Wordware.ai | $30M |

| OneCellDX.com | $16M |

| ReplicacCyber.com | $8M |

| Valantis.xyz | $7.5M |

Raises (U=Undisclosed)

| Domain | Amount |

|---|---|

| Pep2Tango.com | U$M |

| EmpyreanSolutions.com | U$M |

| GunzillaGames.com | U$M |

| OncoVerity.com | U$M |

| LnFi.network | U$M |

| KMS-Technology.com | U$M |

Other Raises

| Domain | Description |

|---|---|

| NeosPartners.com | Raises $1.37B /F2 for renewable energy, power grid, and industrial sectors. |

| LeonidFinance.io | Raises $265M+ for tech companies on government contracts. |

Rebrands

| Old Domain | New Domain |

|---|---|

| MediaLab.com | Vastian.com |

| IroquoisGroup.com | IronPeakNetwork.com |

| TheAbrahamicBusinessCircle.com | TheDealMakers.org |

| eKeeperGroup.com (.co.uk) | Finova.tech |

| PineappleEnergy.com | SUNation.com |

| SparkCognition.com | Avathon.com |

| Hso.co.uk | Syntura.io |

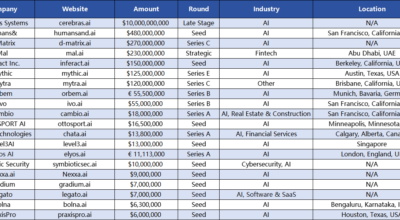

The November 2024 financing report highlights key trends in startup investments, with a focus on companies using premium domain names. The data, curated by Dommunity, captures significant insights into the global startup ecosystem’s ongoing digital transformation efforts.

- Prominent Domain Usage

Domains are not just web addresses—they have become powerful tools for branding and storytelling. Recent investments in domains such as Stax.ai and SilFabSolar.com highlight the growing preference for concise, memorable, and relevant names in the tech and renewable energy sectors. The adoption of descriptive and industry-specific extensions like .ai and .solar demonstrates the strategic alignment of domain names with company missions, ensuring better visibility and market resonance.

- Significant Funding Amounts

The funding landscape is buzzing with activity, with notable amounts raised across various sectors. Stax.ai secured a significant $7M, while SilFabSolar.com made waves with an impressive $100M investment. These raises reflect a growing investor appetite for tech innovations and sustainable solutions. The diversity in industries, from artificial intelligence to clean energy, emphasizes the expansive opportunities available in today’s market.

- Undisclosed Investments

A number of companies continue to attract undisclosed funding, pointing to strategic, often confidential, growth moves. Firms like Pep2Tango.com and LnFi.network are leveraging private investments to innovate and expand. These undisclosed amounts often signal a focus on niche markets or emerging technologies, where details are held closely to maintain competitive advantages.

- Rebranding Efforts

Rebranding is a strategic move for companies to realign with evolving markets or introduce fresh identities. Recent changes, such as MediaLab.com becoming Vastian.com and TheAbrahamicBusinessCircle.com rebranding to TheDealMakers.org, showcase the importance of modernization and clarity in brand messaging. These efforts are essential for staying relevant, enhancing customer perception, and capitalizing on new opportunities.

- Investment Trends

Recent activity in funding and rebranding points to key trends shaping the market. The surge in investments in renewable energy, such as NeosPartners.com’s $1.37B raise, and the continued focus on AI-driven startups highlight the alignment with global priorities like sustainability and innovation. Similarly, the emphasis on domain branding and rebranding signals a heightened awareness of digital identity’s impact on business growth and differentiation.

The article comes from the Internet. If there is any infringement, please notify me to delete it. Please indicate the source when reprinting!

If you have news to publish, please send it to:article@domain.news